July 2025 Societal Shelter Fee Schedule: Secret Schedules and What to expect

Content

- DraftKings promo code: $200 extra bets for Jake Paul versus Anthony Joshua

- When ‘s the ‘Survivor’ 12 months 44 prime?

- How does the new DraftKings indication-right up bonus functions?

- Whenever is actually Societal Defense broadcasting are other January 2026 professionals?

- Finest Survivor Pond Selections to avoid for Month 18

If you were to think your be eligible for it save, mount an announcement from cause and over Mode 5329 as instructed under Waiver of tax to have practical cause from the Tips to own Function 5329. Explore Form 5329 to report the brand new taxation on the excessive accumulations. Additional taxation rate to possess excessive accumulations shorter. Tom must also pay an extra tax from $300 (10% (0.10) × $step three,000). Tom Jones, that is 35 years of age, obtains an excellent $step 3,000 distribution of their antique IRA membership. You’re limited by getting one crisis individual costs shipment for each and every calendar year and also the matter which can be addressed as the a keen emergency individual costs shipping shouldn’t meet or exceed the new less out of $1,000 otherwise their full interest in the fresh IRA.

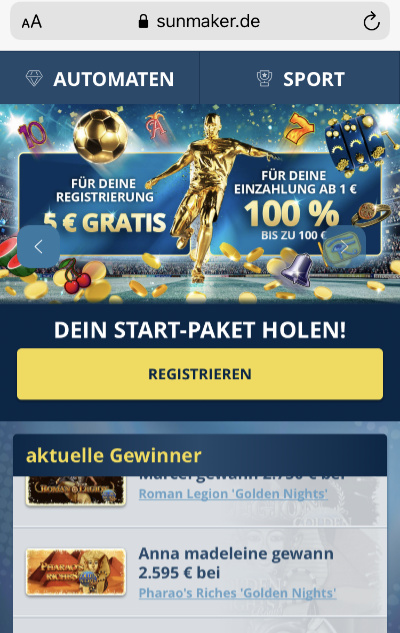

DraftKings promo code: $200 extra bets for Jake Paul versus Anthony Joshua

Concurrently, I’m able to provide outlined tips and you will tips for winning the survivor pools. This guide will highlight the best NFL survivor contest to your 2025 seasons. An educated survivor swimming pools within the 2025 give chances to winnings substantial, secured award pools and enable for numerous entries. The newest noteworthiness of this are controversial, nevertheless Chiefs would be the fifth-preferred group recently, according to Bing.

When ‘s the ‘Survivor’ 12 months 44 prime?

(2) Died while you are at the mercy of FERS retirement efforts made through payroll deduction for every pay period on the FERS Later years and Handicap Financing. (1) Finished at least 1 . 5 years from creditable civil service; and you may Depending on the World Fitness Organization, between Jan. step three, 2020 and you will July twenty eight, 2022, there have been 1,020,100 fatalities in the usa associated with the fresh COVID-19 pandemic. Delivering accepted to possess impairment requires a long time. You will not receive any impairment payments up until once the application is actually approved. When you use lead deposit plus payment are late in order to your money, get hold of your standard bank.

The fresh Vegas Moneyline is the mediocre of your matchup’s a few moneylines. Ownership percentages less than are from Yahoo. The new Chargers was all of our third-favorite discover a week ago. Survivor swimming pools thinned a small last week to your Chargers dropping to your Jaxson Dart Creatures and you may, to help you less extent, the brand new Packers tying the new Cowboys, and this matters since the a loss in really pools.

To have reason for calculating your expected minimum delivery, their relationship status is determined since January 1 of each and every seasons. Because of this for many who discovered more their expected minimal shipment inside the 1 year, you can’t get rid of the other (the total amount which is more the required minimal delivery) inside your required minimum shipment for the later on season. The total amount that must be marketed annually is described as the required lowest shipment.

(ii) Not creditable instead deposit for any other purpose, except for average shell out computation intentions. (2) The number of occasions regarding the employee’s regularly arranged trip away from responsibility inside an excellent 52-week-work season. (1) The number of occasions that the employee try entitled to first shell out if or not inside the a duty otherwise paid back exit status (never to surpass 2000 to possess Postal group otherwise 2080 to own non-postal group) on the 52-week work year immediately preceding the conclusion the very last pay months where the staff was a student in a pay condition; otherwise (a) The fresh yearly shell out of a member-go out (frequently arranged) staff ‘s the device of your employee’s latest hourly rate of shell out and the highest of—

When someone besides the proprietor otherwise recipient of a vintage IRA partcipates in a blocked transaction, that person can be liable for certain fees. Your bank account or annuity does not lose the IRA medication if the https://happy-gambler.com/snake-slot/ company or the worker relationship which have the person you get old-fashioned IRA partcipates in a banned transaction. You may need to pay the 10% a lot more tax to the early withdrawals, talked about later. Essentially, if you or your recipient partcipates in a prohibited purchase inside contact with your antique IRA membership any moment inside year, the newest account finishes getting an IRA by the first time of this 12 months. Which chapter talks about the individuals acts (in accordance with distributions) that you ought to stop as well as the additional taxation or any other will cost you, along with death of IRA reputation, you to apply if not end the individuals acts. The new taxation advantages of having fun with antique IRAs for old age offers is become offset by more taxation and punishment otherwise go after the guidelines.

How does the new DraftKings indication-right up bonus functions?

![]()

All the information provided less than can assist make suggestions from the process out of reporting the fresh loss of a federal personnel or retiree and you can making an application for any possible passing benefits which are payable. After qualification to possess SSI pros try verified, the newest SSA will use this article in order to deposit monthly premiums myself to the beneficiary’s family savings. She waited up to complete retirement to allege survivor advantages. Personnel there may guess the quantity indeed owed and explain after that exactly how future retirement benefits could be impacted by people a fantastic deposit or redeposit. While the enactment of these laws, FERS group could make redeposits having desire in order to count that point inside their FERS work for data.

- That it directory is increased by enhanced rising prices rates you to enhance the cost of products or services.

- A great QCD can be a nontaxable distribution generated individually by the trustee of the IRA (besides a continuing Sep otherwise Simple IRA) so you can an organisation entitled to receive tax-allowable efforts.

- Rather, you can join 100 percent free leagues and have all the fun of survivor leagues without risks.

- We refuge’t got as frequently achievements having survivor whenever i provides which have discover ’em pools, and so i stand on the $ten and you will $a hundred records.

- When a dead employee otherwise retiree has not yet named a beneficiary plus one of your own second from kin entitled produces a claim to your accumulated benefit, most other second of kin permitted display regarding the unexpended harmony otherwise accrued benefit can get specify the one who made the fresh allege to do something as his or her agent to get the distributive offers.

Whenever is actually Societal Defense broadcasting are other January 2026 professionals?

If you inherit a classic IRA out of your spouse, you generally feel the following the three alternatives. For many who inherit a traditional IRA, you are titled a beneficiary. Inside guide, the initial IRA (either named an ordinary otherwise regular IRA) is known as a “antique IRA.” A vintage IRA is actually any IRA this isn’t a great Roth IRA otherwise an easy IRA. Ordering tax models, instructions, and you will courses. Visit Irs.gov/Forms so you can obtain newest and you can prior-season variations, tips, and you may courses.

The newest Irs will not insist an excise taxation inside 2024 to own missed RMDs if the the needs is actually fulfilled. Work for repayments try posted on the first working day of the week. Innovative Broker imposes a great $1,one hundred thousand minimal to own Dvds ordered due to Innovative Broker. For further information from visibility qualifications and you will insurance policies limits for other sort of membership, go to As of July 21, 2010, the Dvds are federally covered around $250,000 per depositor for every lender. Innovative Brokerage cannot create a market in the brokered Cds.

(1) The newest surviving spouse elects to get the fresh reinstated current partner annuity rather than all other repayments (but people accumulated however, unpaid annuity and any outstanding staff contributions) to which he or she could be named less than FERS, or other later years system for Authorities personnel, by the cause of your own remarriage; and you can (b) To own satisfying the brand new 9-week wedding dependence on section (a)(1) of the section, the fresh aggregate lifetime of the marriage ceremonies amongst the partner trying to get a recent spouse annuity and the retiree, employee, otherwise split staff is included. So it app includes guidelines to aid the fresh retiree inside the estimating the degree of loss of the brand new annuity to own most recent companion annuity and the number of the mandatory put. (v) No current mate, other former companion, or insurable focus designee receives otherwise could have been designated to found a survivor annuity in accordance with the provider of one’s staff, Associate, or retiree. (a) Except as the provided inside paragraph (b) for the point, latest companion annuities, former companion annuities, kid’s survivor annuities, and you can survivor annuities for beneficiaries away from insurable attention annuities less than CSRS beginning to accrue on the day once loss of the new employee, Associate, otherwise retiree.

Once you reach many years 59½, you can discovered distributions without having to pay the brand new 10% extra income tax. Declaration completely taxable withdrawals, and very early distributions, for the Setting 1040, 1040-SR, otherwise 1040-NR, line 4b (zero entryway is required on the web 4a). When calculating the newest nontaxable and you will taxable levels of withdrawals made previous so you can dying around the newest IRA membership holder passes away, the worth of the traditional (in addition to Sep) and simple IRAs might be thought as of the new go out away from dying instead of December 31.

Finest Survivor Pond Selections to avoid for Month 18

Certain claims in addition to adminsiter supplemental repayments — which you are able to read more on the here. That being said, since the average salaries and you may every hour earnings will vary centered on area, being aware what individuals are getting in your home condition will help you get a getting for what to anticipate. Capture our 2-minute quiz to see if your be eligible for professionals and you can cam having a team affiliate concerning your handicap claim. If making an application for handicap pros is found on their in order to-create listing inside 2025, Atticus might help. For example, for many who received a keen SSDI percentage on the third Wednesday out of per month within the 2024, you’ll continue to discover money on the same plan inside the 2025.

(j) A member of staff otherwise Member will get term just one absolute people since the the newest called recipient from a keen insurable focus annuity. (2) The rate away from annuity paid off to the recipient out of an insurable interest election, when the employee otherwise Affiliate and decided to go with a completely reduced annuity otherwise a partly shorter annuity, translates to 55 (otherwise fifty percent when the according to a break up prior to October eleven, 1962) % of one’s speed away from annuity pursuing the insurable desire prevention. (4) The fresh employee otherwise Member may be required to submit documentary facts to determine the new entitled beneficiary’s time from delivery. (e) An enthusiastic insurable focus annuity could be select to include a survivor work for only for somebody who features a keen insurable interest in the new retiring staff otherwise Associate. (d) To elect an insurable desire annuity, a member of staff otherwise Associate have to suggest the brand new intent to really make the election on the application to own old age; submit evidence to exhibit that he or she is actually an excellent health; and you will plan and you will purchase the medical test that shows one he’s within the great health. Lifetime of retirement function the new productive starting go out to possess a great resigned employee’s otherwise Member’s annuity.