THE BIGGEST MISTAKES NEW TRADERS AND INVESTORS MAKE

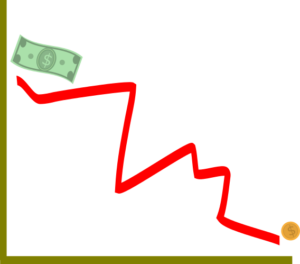

Most beginn er traders and investors in the stock market lose part or even all of their invested capital in the markets. Though the reasons why this happens has been analyzed again and again; newbies in this market continue to experience these difficulties. Though this could be attributed to ignorance or lack of knowledge, it could be that the psychology of new traders is exploited by the market dynamics.

er traders and investors in the stock market lose part or even all of their invested capital in the markets. Though the reasons why this happens has been analyzed again and again; newbies in this market continue to experience these difficulties. Though this could be attributed to ignorance or lack of knowledge, it could be that the psychology of new traders is exploited by the market dynamics.

For instance, they may get fascinated by the possibilities of profit the market provides and hence look to book profits quickly. Such frequency in trading can result to the newbie trader or investor falling into market traps easily.

Let us explore some of the mistakes new traders make.

1. Not cutting their losses in time; we have always heard of the phrase; “Cut your losses quickly and let your profits run”. Though this is repeated over and over, new traders continue falling short of doing that by the mere excitement of booking some profits early. They are also not prepared to take a loss and usually wait for the market to turn around and head to their direction. Markets trend and their loosing position quickly consume their capital and also hold margin that could have used to place other trades.

2. High Leverage; most new traders approach the market from a ‘get rich quick’ perspective. This leads to high use of leverage in order to win big. Though this is possible, leverage also amplifies the losing side. Hence a number of consecutive losing trades will wipe out their trading capital.

3. Over-trading; experienced traders and investors always advice newbies to take trading as a business and not a hobby. However, the excitement of trading influences the habits of new traders easily. This makes them place numerous trades and watch several unrelated markets at the same time. More often than not, their mindset and trading approach becomes overstretched rendering them inefficient in trading.

4. Relying on others; new traders often follow the so called “trading gurus”. This ranges from following major online financial analysts to social media. By doing this, they abandon they trading plan and approach leading to inconsistency in their results and finally losses.

5. Lack of a trading plan; discipline is a major trait that successful traders possess. They create a trading plan based on their trading strategy and stick to it leading to consistency in their trading. They are also able to track their mistakes from the trading plan and correct accordingly. On the other hand, new traders do not keep a trading plan and end up moving from strategy to strategy and following others as discussed in mistake 4.

6. Adding into losing positions; new traders double their losing positions in the hope of getting a breakeven. This is disastrous especially in a trending market. If the market continues to move against their positions they end up with huge losses and the risk of losing their entire capital.

7. Slacking in acquiring more skill; experienced traders reached their level by working hard and acquiring more skills to survive and make profits from the market. On the other hand, new traders think that making money from the market is easy and rarely put enough effort till it is too late.

provera 30mg

Understanding COSC Accreditation and Its Importance in Watchmaking

COSC Validation and its Strict Criteria

Controle Officiel Suisse des Chronometres, or the Official Swiss Chronometer Testing Agency, is the official Swiss testing agency that certifies the accuracy and precision of timepieces. COSC validation is a symbol of superior craftsmanship and reliability in chronometry. Not all watch brands seek COSC accreditation, such as Hublot, which instead follows to its own strict criteria with movements like the UNICO calibre, attaining similar accuracy.

The Science of Precision Timekeeping

The central system of a mechanical watch involves the mainspring, which provides power as it loosens. This mechanism, however, can be prone to environmental factors that may affect its accuracy. COSC-accredited mechanisms undergo rigorous testing—over 15 days in various conditions (5 positions, 3 temperatures)—to ensure their durability and dependability. The tests assess:

Mean daily rate precision between -4 and +6 secs.

Mean variation, maximum variation rates, and impacts of thermal changes.

Why COSC Certification Matters

For watch aficionados and connoisseurs, a COSC-certified watch isn’t just a item of tech but a demonstration to lasting excellence and precision. It symbolizes a watch that:

Presents exceptional reliability and accuracy.

Offers confidence of superiority across the entire design of the watch.

Is likely to hold its value more effectively, making it a smart choice.

Popular Timepiece Brands

Several well-known manufacturers prioritize COSC accreditation for their timepieces, including Rolex, Omega, Breitling, and Longines, among others. Longines, for instance, presents collections like the Archive and Soul, which showcase COSC-accredited mechanisms equipped with cutting-edge substances like silicon balance suspensions to boost resilience and efficiency.

Historical Context and the Development of Timepieces

The concept of the chronometer originates back to the need for accurate timekeeping for navigational at sea, emphasized by John Harrison’s work in the eighteenth cent. Since the official establishment of COSC in 1973, the accreditation has become a benchmark for judging the precision of luxury timepieces, continuing a legacy of excellence in watchmaking.

Conclusion

Owning a COSC-accredited watch is more than an visual selection; it’s a dedication to quality and precision. For those appreciating precision above all, the COSC validation offers peace of thoughts, ensuring that each validated timepiece will function dependably under various circumstances. Whether for personal satisfaction or as an investment decision, COSC-accredited timepieces distinguish themselves in the world of watchmaking, bearing on a legacy of precise timekeeping.

주식신용

로드스탁과 레버리지 방식의 스탁: 투자의 참신한 영역

로드스탁에서 제공하는 레버리지 스탁은 주식 시장의 투자의 한 방법으로, 큰 수익률을 목적으로 하는 투자자들을 위해 유혹적인 옵션입니다. 레버리지를 이용하는 이 전략은 투자자들이 자신의 투자금을 넘어서는 투자금을 투입할 수 있도록 하여, 주식 장에서 더 큰 작용을 행사할 수 있는 기회를 공급합니다.

레버리지 스탁의 원리

레버리지 스탁은 일반적으로 투자금을 차입하여 투자하는 방식입니다. 사례를 들어, 100만 원의 자금으로 1,000만 원 상당의 주식을 사들일 수 있는데, 이는 투자자들이 일반적인 투자 금액보다 훨씬 더욱 많은 주식을 구매하여, 주식 가격이 증가할 경우 관련된 훨씬 더 큰 이익을 얻을 수 있게 됩니다. 그렇지만, 증권 가격이 하락할 경우에는 그 손해 또한 증가할 수 있으므로, 레버리지를 사용할 때는 신중해야 합니다.

투자 전략과 레버리지 사용

레버리지는 특히 성장 가능성이 높은 사업체에 투자할 때 도움이 됩니다. 이러한 사업체에 높은 비중으로 적용하면, 성공적일 경우 상당한 수입을 가져올 수 있지만, 반대의 경우 큰 리스크도 감수하게 됩니다. 그렇기 때문에, 투자자는 자신의 위험성 관리 능력을 가진 장터 분석을 통해 통해, 일정한 기업에 얼마만큼의 투자금을 적용할지 결정해야 합니다.

레버리지의 장점과 위험성

레버리지 방식의 스탁은 상당한 수익을 제공하지만, 그만큼 상당한 위험성 따릅니다. 주식 시장의 변동은 예상이 힘들기 때문에, 레버리지 사용을 이용할 때는 늘 장터 동향을 세심하게 주시하고, 손실을 최소화하기 위해 수 있는 계획을 마련해야 합니다.

결론: 조심스러운 고르기가 요구됩니다

로드스탁을 통해 공급하는 레버리지 방식의 스탁은 강력한 투자 도구이며, 적당히 이용하면 큰 수입을 제공할 수 있습니다. 그러나 상당한 위험성도 생각해 봐야 하며, 투자 선택은 필요한 사실과 조심스러운 생각 후에 진행되어야 합니다. 투자자 자신의 재정 상황, 위험을 감수하는 능력, 그리고 시장의 상황을 반영한 균형 잡힌 투자 전략이 중요합니다.

Productive Hyperlinks in Blogs and Comments: Increase Your SEO

Hyperlinks are critical for improving search engine rankings and enhancing website visibility. By including links into blogs and comments prudently, they can significantly boost visitors and SEO performance.

Adhering to Search Engine Algorithms

Today’s backlink placement methods are finely tuned to align with search engine algorithms, which now emphasize website link high quality and relevance. This assures that backlinks are not just numerous but meaningful, guiding consumers to beneficial and pertinent articles. Website owners should emphasis on integrating hyperlinks that are situationally proper and enhance the overall content good quality.

Benefits of Utilizing Fresh Contributor Bases

Using current contributor bases for links, like those handled by Alex, provides significant advantages. These bases are often refreshed and consist of unmoderated sites that don’t attract complaints, making sure the links placed are both powerful and agreeable. This approach helps in keeping the usefulness of backlinks without the risks connected with moderated or troublesome sources.

Only Approved Sources

All donor sites used are sanctioned, steering clear of legal pitfalls and sticking to digital marketing requirements. This determination to using only sanctioned resources assures that each backlink is genuine and trustworthy, thus developing credibility and reliability in your digital existence.

SEO Impact

Skillfully placed backlinks in weblogs and comments provide more than just SEO benefits—they enhance user experience by linking to pertinent and high-quality content. This technique not only meets search engine conditions but also engages consumers, leading to much better visitors and enhanced online engagement.

In substance, the right backlink strategy, particularly one that utilizes fresh and trustworthy donor bases like Alex’s, can transform your SEO efforts. By concentrating on good quality over amount and sticking to the most recent criteria, you can ensure your backlinks are both powerful and efficient.